Why Does the Market Keep Going Up?

This is the question I’m most frequently asked. Second place goes to “How Long Will the Market Keep Going Up?” I can give you a reasonable explanation for the first question; I have no clue about the second question (although the answer to the first question is a hint). Our country and the major corporations listed on stock exchanges thrive when the economy is fueled by spending.

There are three principal forms of spending:

- Government

- Corporate

- Consumer

There’s also a “fudge factor” of Net Exports that can either be positive or negative. The collective result is defined as Gross Domestic Product (GDP). With the outbreak of COVID, everyone was logically concerned about the negative impact on Corporate Spending and expected the economy to come tumbling down. Fortunately, that’s just one leg of the stool.

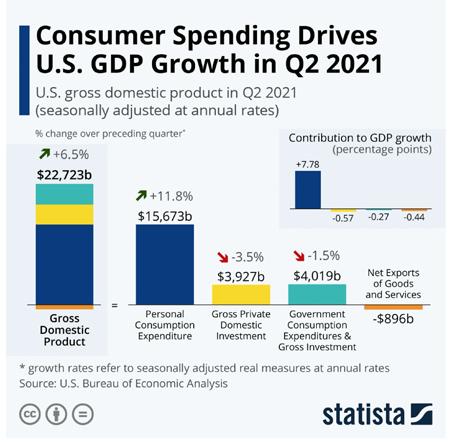

The chart below shows spending for the most recent quarter, which is characteristic for what has happened for the past year – Government and Corporate Spending, along with Net Exports have been negative. Consumer Spending has gone ballistic.

Bottom Line: Consumers have been spending money like drunken sailors! Based on changes in alcohol purchases, this may be an appropriate portrayal.

Last quarter GDP rose 6.5%; Consumer Spending rose 7.78%, while the other factors declined. Much of this Consumer Spending growth is a direct result of two things:

- Various stimulus packages that provided funds

- People being isolated at home and getting bored. They’ve had more time to focus on ways to improve their life during the pandemic.

The result was the boom in Home Improvement, Nursery and Gardening companies, Food and Grocery Delivery, Alcohol purchases and Mail Order companies. I suspect that this behavioral aspect will be carefully studied in years to come.

So, you may now infer the answer to the question “How Long Will the Market Keep Going Up?” – until consumers quit spending like drunken sailors!

Rick Adkins, CFP®, ChFC, MBA

![]()

© 2021 The Arkansas Financial Group, Inc., All rights reserved.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. [“AFG]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from AFG. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the AFG’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.arfinancial.com.

Please Rrmember: If you are a AFG client, please contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.