What, Me Worry?

A discussion of the concerns that keep Americans awake at night

As a pre-pubescent boy, I was unduly influenced by MAD Magazine. The poster boy for that publication was Alfred E. Neuman. The character of Mr. Neuman frequently appeared with the tagline, “Me Worry?” This implied that the angst of the war in Viet Nam, social insurrection, assassinations of world leaders, and the generally untrustworthy “establishment” didn’t worry Mr. Neuman in the least.

I mean, look at that face. There’s nothing that a good plastic surgeon and orthodontist couldn’t fix! What’s not easily fixed is his theoretical absence of worry. Sixty years down the road, I see worry in a quite different light. I now understand how little I can control. There are so many things that can go wrong. If I obsessed over all of those, I would lose my mind. I’ve become a strong adherent to the Serenity Prayer.

Americans’ Top Concerns

What are your greatest worries today? Are your worries about your own body and mind, your children and grandchildren, your finances, our country, world events, or the water leak your plumber can’t seem to fix? There’s much for humans to worry over.

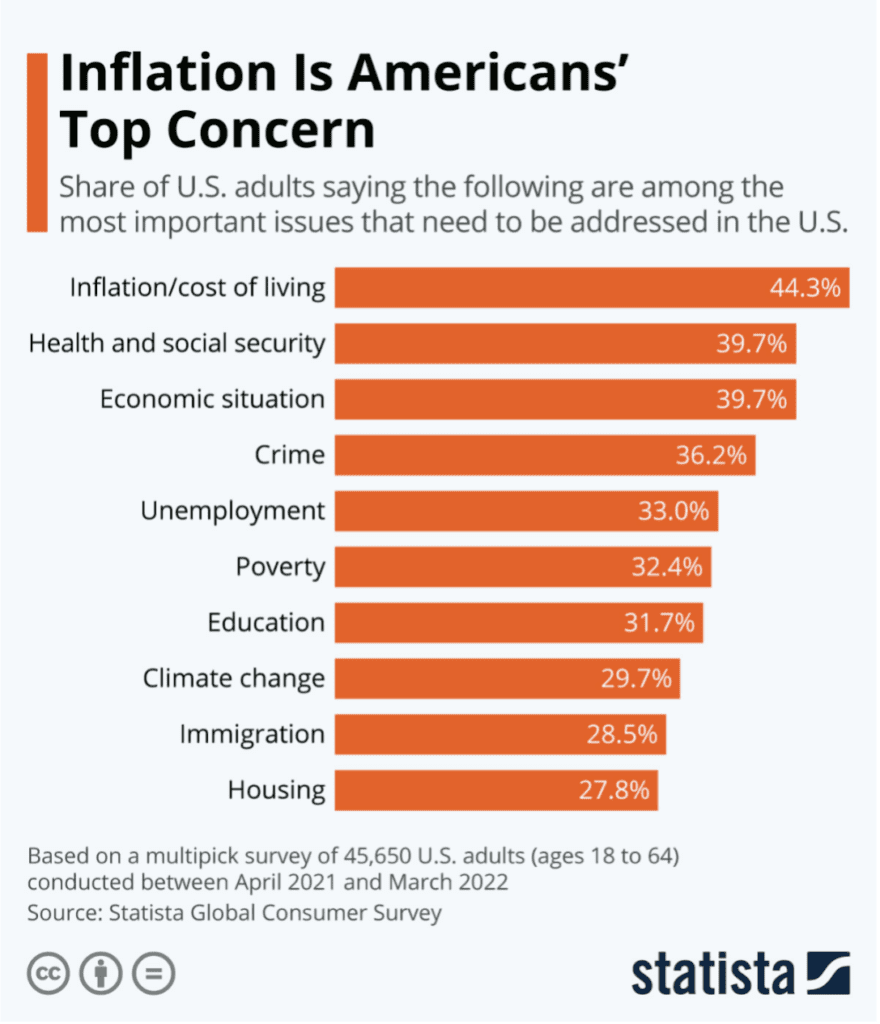

A survey was recently conducted about the top concerns of Americans. The chart below lists American’s Top Ten Concerns. Several of them are troublesome. Your greatest concern may be number seventh or eighth on the list. Yet if that’s what is most concerning to you it doesn’t really matter where it ranks on everyone else’s list. For you, the question “What’s causing me to lose sleep tonight?” is the real issue.

When I look at the list, I suspect that the lead stories that we’re seeing in the news tend to gravitate toward the top. If your news sources tell you, “You should be worried about this,” that can influence your worries.

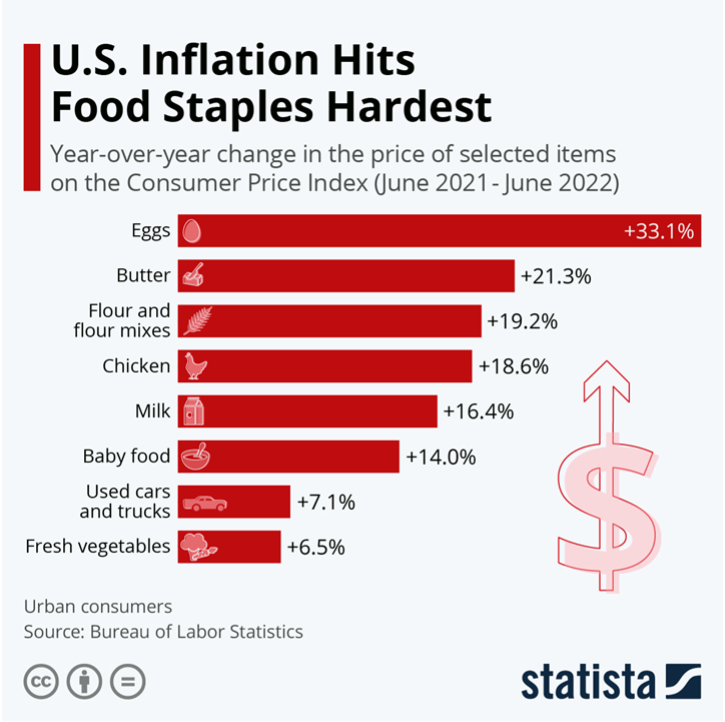

Inflation currently tops the list. While cars and meat drove inflation a year ago, now it’s shifted to energy and basic food costs: eggs, butter, flour, chicken, and milk. Inflation has been classically defined as “too much money chasing too few goods.” To restate that in current terms it would be re-defined as, “too much stimulus money chasing goods that are sitting on gigantic tanker ships off our coasts because COVID reduced the workforce to unload and deliver them.”

There is a light at the end of the inflation tunnel. You may have seen recent stories about retailers who are now being overwhelmed at the delivery of those goods who are now overstocked in inventory. Energy prices appear to be peaking. When you take out the food and energy components, we’re at an inflation level of 5.9 percent. It will be good when this all settles toward equilibrium.

Inflation is a very personal thing. Your inflation rate is not your neighbor’s inflation rate. Your inflation rate may be 6.3% or 4.6%, not necessarily the average rate of 9.1%. If you’re a meticulous expense tracker, you could easily compute your inflation rate in various areas.

In many respects, MAD Magazine did cut through the worry of the sixties. Spy vs. Spy got to the core of what our schoolroom nuclear attack duck and cover drills were implying — that we were living in the insanity of Cold War brinksmanship. Subtle worry was simply a part of life. The films we were shown on “what it would be like if the Communists take over” also planted worry in our brains. It also caused us to question some of the things we were being told (or not told).

In its own way, MAD Magazine called out the fake news of the sixties. The difference was that while it could be cynical, it could be humorous, gentle and endearing. Maybe what we need is a rebirth of ole Alfred. His take on today would be quite interesting. He might help us worry about the things that really matter, like “Where did I put my keys?”

Rick Adkins, CFP®, ChFC, MBA

![]()

© 2022 The Arkansas Financial Group, Inc., All rights reserved.

The Arkansas Financial Group, Inc. is a Fee-Only Financial Planning Firm located in Little Rock, AR serving clients in Arkansas and throughout the country.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. [“AFG]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from AFG. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the AFG’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.arfinancial.com.

Please Remember: If you are a AFG client, please contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.