Update: Unemployment Insurance Fraud & Identity Theft

In May, the U.S. Secret Service reported a massive fraud against state unemployment insurance programs with estimated losses in the hundreds of millions of dollars. This is thought to be a well-organized Nigerian crime ring exploiting the COVID-19 crisis. They are filing unemployment claims in different states using Social Security numbers and other Personally Identifiable Information (PII) belonging to identity theft victims.

In their memo they reported, “a substantial amount of the fraudulent benefits submitted have used PII from first responders, government personnel, and school employees.” At the time of the May memo, the primary attacks were in Washington State, but attacks were also reported in North Carolina, Massachusetts, Rhode Island, Oklahoma, Wyoming, and Florida.

Fraud Attacks in Arkansas

Arkansas has now seen a number of these fraud attacks, and we have clients who are teachers and physicians who have had unemployment benefits filed under their names, using their PII (which includes their quarterly earnings records). The attack is so sophisticated that they have used other databases to be able to alter the “claimant’s” address so that you do not get the notice from the State Unemployment Office. Additionally, they were able to hack those state systems so that the claim was simultaneously filed, approved and paid. To add insult to injury, no taxes are being withheld, so you will be receiving a 1099 in 2021 for any benefits paid from your account this year.

Given the number of people that we are aware of, this is a significant attack with affected individuals in Arkansas numbering in the thousands. You should be alert to all paper mail that you receive, and if you receive, notice from the Arkansas Department of Workforce Services (ADWS) that an unemployment claim has been filed you should immediately take the following steps (WARNING: This is a very fluid situation, so these procedures will continue to evolve):

- ADWS has just released a new procedure to report fraudulent unemployment claims. Contact the Fraud Hotline at 501-682-1058 immediately.

- Call the Little Rock Police Department Telephone Reporting Unit (TRU) at 501-918-4397 and file a police report. You will need the incident number from the police report to give to ADWS. The TRU hours are 9:30-6pm, but phone lines have been overwhelmed. Waits on hold have been between 45 minutes and 2 hours. The “leave a message” prompt has not been working.

- Once you have the incident number from the police report, DWS has trained more workers to answer the hotline, so you should be able to get through quicker. If the claimant/employee/victim contacts DWS directly, the claim can be stopped permanently. Claimants will also be instructed to follow up by emailing a police report to ADWS.InternalAudit@arkansas.gov.

- Unless they have updated their procedures, you may ultimately have to go to one of the local ADWS offices. You will give them a copy of your Drivers license, a copy of the letter you received from ADWS, your name, SS#, address, and a copy of the police report incident number. All of this is required for ADWS to stop payments and correct the fraudulent transactions.

Claim Notices from ADWS

You may not even be aware that a claim has been filed against you, if another address has been used. My partner’s wife was a victim and only learned of the claim because it happened to go to her daughter’s address. We recommend that you utilize social media to request that if any of your “friends” receive a Claim Notice from ADWS for your or anyone else to please let them know immediately. You only have a 20-day period from the date of filing to appeal.

If this has happened to you, you should assume that your personal information (PII) has been compromised, and you should consider doing the following:

- Review your credit reports with Equifax, TransUnion, and Experian. Consider placing restrictions on opening any new accounts or lines of credit with these agencies.

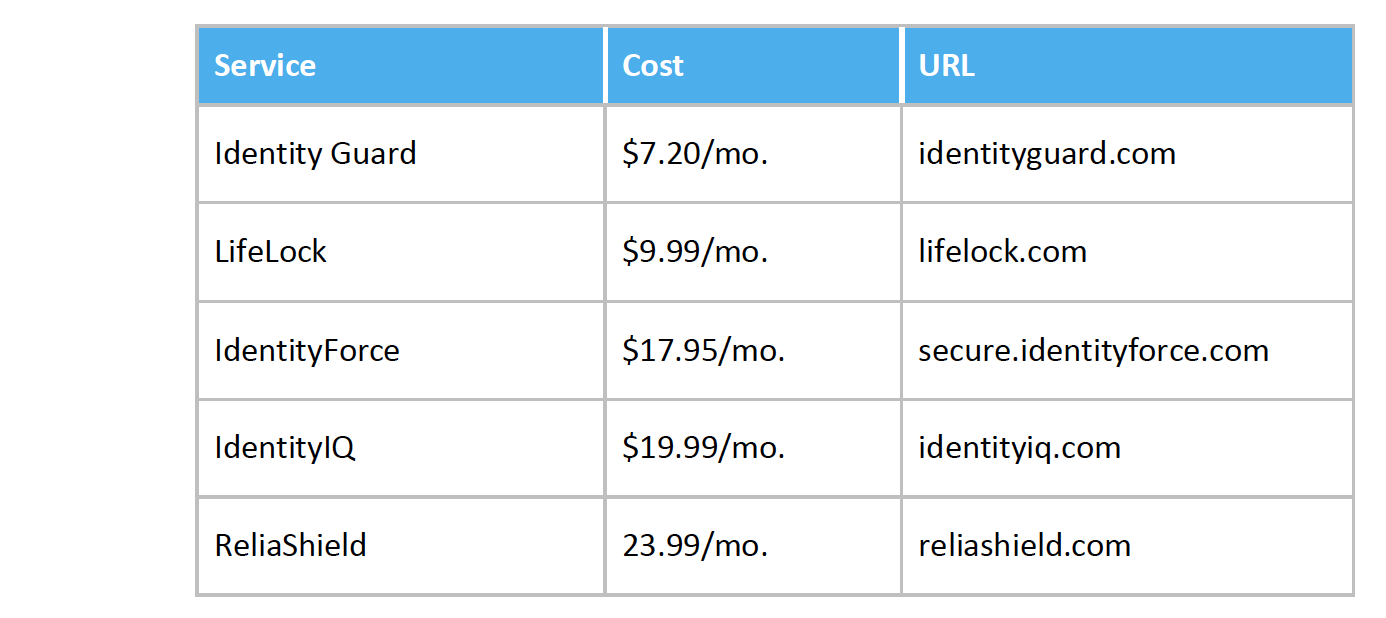

- Explore purchasing identity theft protection from one of the following:

- Turn on two-factor authentication for all financial accounts, emails, and social media.

- Consider locking down your investment accounts to restrict any money transfers without authorization.

- Learn about using VPN for wireless security.

It is disheartening that these events happen, but it is a good reminder of the need to be vigilant and have protections in place to protect your personal information and finances.

As always, we are here for you. Please email or call if you want to set up a Zoom videoconference meeting or talk by phone.

Ralph Broadwater, M.D., CFP®, AIF®

© 2020 The Arkansas Financial Group, Inc., All rights reserved.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. (“AFG”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from AFG. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of AFG’s current written disclosure Brochure discussing our advisory services and fees is available upon request.

Please Note: If you are a AFG client, please remember to contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. AFG shall continue to rely on the accuracy of information that you have provided.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.