The Debt Ceiling: What You Should Know

What is the history of the U.S. debt ceiling?

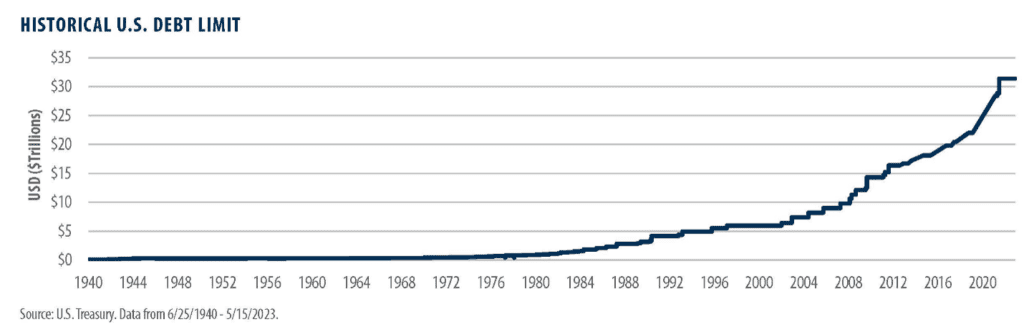

Congress created the United Sates debt ceiling in 1917 when it passed the Second Liberty Bond Act. Before this, parliamentary rules limited government borrowing. Congress had to approve each issuance of debt in a separate piece of legislation. Since the end of World War II, Congress has raised, extended, or revised the debt limit more than one hundred times. The statutory debt limit is the maximum amount of money that the U.S. government can borrow from investors, itself, and other countries to finance its operations and obligations. The current debt ceiling is $31.4 trillion. The United States exceeded the debt ceiling earlier this year.

Congress has the power to raise the debt ceiling. They must pass legislation that increases the debt limit for the government to continue borrowing money and paying its bills. Once the debt ceiling is exceeded, the government can no longer borrow money to pay its bills. The President and Congress usually hold budget negotiations to raise the debt ceiling. In recent years, Congress has often used these negotiations to address other issues such as spending cuts or tax reform. Congress may vote to increase the debt ceiling without any additional policy changes if an agreement cannot be reached between the parties. Congress and the White House have delayed addressing the debt ceiling, and today there is a sense of urgency since the Treasury can only pay its bills until June 1, 2023, before risking default.

What is the history of not raising the debt ceiling?

In the past, Congress has been unable to reach an agreement on raising the debt ceiling, leading to a government shutdown and potential default. In 2013, Congress was unable to pass a budget resolution that would raise the debt ceiling, resulting in a 16-day government shutdown. Similarly, in 2011, Congress was unable to agree on raising the debt ceiling which resulted in Standard & Poor’s downgrading of U.S. credit rating for the first time ever.

What would be the impact of not raising the debt ceiling?

Not raising the debt ceiling could have serious implications for inflation and the stock market. If the government defaults on its obligations, it could lead to a decrease in consumer confidence, which could cause a decrease in spending and investment. This could lead to an increase in inflation as prices of goods and services rise due to decreased supply. A default could also cause a decline in stock prices as investors become more cautious about investing their money. If the debt ceiling is not raised, it could also have negative consequences for home values, and credit ratings. A downgrade of the U.S. credit rating by credit rating agencies, would lead to increased borrowing costs for businesses and households. It would likely cause a decline in real GDP and 2 million lost jobs. This economic downturn would prompt a spike in unemployment and cause home values to decrease.

Where are we with current negotiations?

Yesterday the Wall Street Journal summarized the current state of negotiations between the Republicans, House Speaker Kevin McCarthy, the Democrats, and President Biden.[i]

The central focus of negotiations has been on slowing government spending. Republicans have communicated that any deal must result in lower discretionary spending next year. President Biden has said he would agree to freeze discretionary spending next year, and cap future increases for two years. The two sides remain far apart, but there has been agreement on several issues.

What about the talk of President Biden using the 14th Amendment to resolve this?

The 14th Amendment has been proposed as a potential solution to resolve the debt ceiling crisis. The amendment states that “the validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned.” Some experts opine that this means that if President Biden were to invoke the 14th Amendment, he would be able to keep borrowing money past the debt limit without needing congressional approval. No president has ever used this approach before, and it is still unclear whether it would be successful. Some legal experts argue that it would be exceeding presidential authority and is unconstitutional.

What do I think will happen?

While the Democrats and Republicans are playing a game of political chicken, they are both positioning themselves to reach a compromise that maximizes their interests but resolves the standoff before the June 1st deadline.

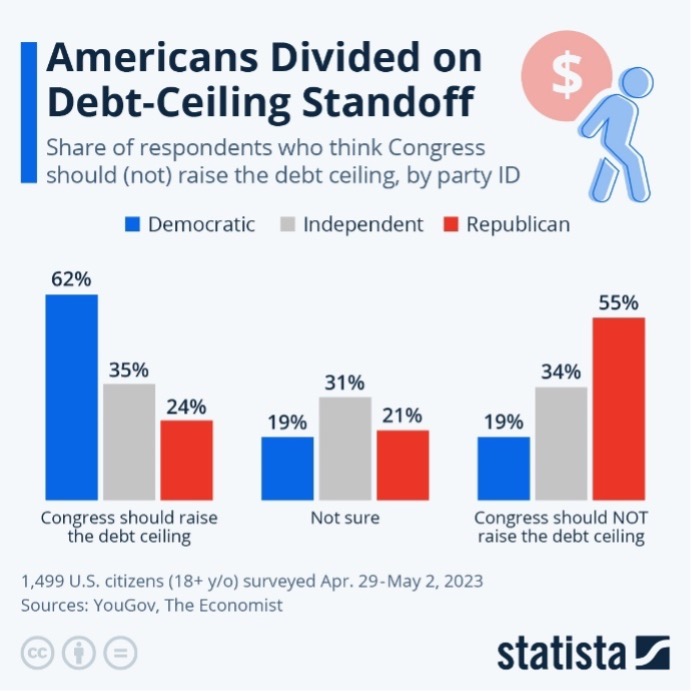

The media and government officials weigh in to create an atmosphere of increased crisis and to influence public opinion. Influencing public opinion may be difficult since Americans are strongly divided on the solutions for solving the debt-ceiling standoff.

If the impasse is not resolved by June 1st, I believe the politicians will negotiate a quick compromise to prevent the adverse economic effects from a prolonged government shutdown.My best advice is to avoid television news, Twitter, and other media. I believe our politicians will find a compromise, and the government will have frozen its increase in spending. Unfortunately, contentious issues will have been “kicked down the road” to be dealt with by future politicians.

[i] 1Hughes S, Restuccia A. Debt Ceiling Fight Comes Down to Spending: Freeze or Cut? The Wall Street Journal, May 14, 2023

Ralph Broadwater, M.D., CFP®

![]()

© 2023 The Arkansas Financial Group, Inc., All rights reserved.

The Arkansas Financial Group, Inc. is a Fee-Only Financial Planning Firm located in Little Rock, AR serving clients in Arkansas and throughout the country.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. [“AFG]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from AFG. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the AFG’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.arfinancial.com.

Please Remember: If you are a AFG client, please contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.