The Current Hot Asset Classes

I’m always fascinated with how an out-of-favor, underperforming asset class can become the darling of Wall Street in a relatively short period of time. More amazing is the financial amnesia that causes both professionals and lay people alike to forget those “dog days” entirely. If you go back thirty years, you’ll see where various asset classes such as Emerging Markets, Financial Stocks and Healthcare Stocks were the clear picks for the “smart money” for several years. And then they weren’t.

The current hot asset classes are Technology, Large-Cap Growth and the S&P 500 Composite. Twelve years ago, the S&P was perceived as a major dog. Most portfolios outperformed it and they didn’t have the downside losses that it experienced. The Dow-30 and the S&P Midcap consistently outperformed the S&P 500. Yet today no one seems to remember that.

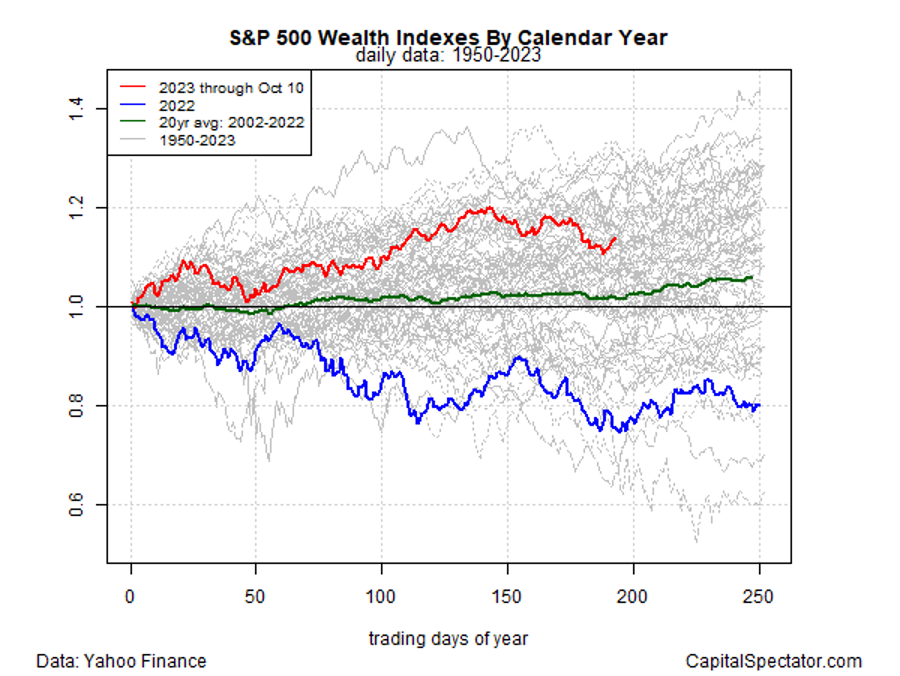

The chart below caught my attention this week. It shows this year (Red Line) and last year’s performance (Blue Line) for the S&P 500, but it also shows the individual performance for each year (those faint Gray Lines) going back to 1950. It then shows the average return for those seventy-four years. That’s the Green Line. Not so impressive.

So, what should you make of this information? Here are my recommendations:

- Don’t get caught up in the trap of wishing all of your money was in the “top” asset class at the current time. That can change on a dime. The year Emerging Markets had its greatest gain (80%), it lost over half of its value the next year. Healthcare was the top dog for ten years. Yet it has been shockingly down for the past three years. Financials ruled for a time and then the financial crisis changed things dramatically. The Dow had been the consistent top performer in the Large Cap space. It has clearly lagged the S&P and Growth over the past two years. Things that go up will ultimately go down.

- There’s more to portfolio performance than just the collective returns. Because of the ups and downs of all asset classes, rebalancing is critical. The tech bubble was catastrophic if you had all your eggs in the Technology bucket. Yet if you had a rational allocation and rebalanced with discipline, you were systematically harvesting Technology gains on the way up. Then the profits didn’t just go “Poof” when the bubble burst.

- Emotionally it’s harder to rebalance into an asset class than to rebalance out. Taking a gain isn’t exactly easy but buying into something that is (and maybe has been) going down can be really tough. Funny thing – that’s what value managers do every day. They are looking for undervalued stocks that have a strong probability of increasing in value. Asset Classes are similar, but with one key difference – it’s a diversified bucket. You aren’t depending on one stock to make or break your day. When you are using an ETF for an Asset Class, you may be purchasing anywhere from 30 to 1,500 stocks. Trends for an entire asset class are easier to measure and quantify, consistently. There’s a little less “whim.”

My greatest surprise so far this year has been year-to-date returns. Markets have been so up one month and down the next that it’s been difficult to get comfortable with performance. Additionally, we still have three months to go. With all that is happening in the world and in our country, who knows if the year will end net positive or net negative. Fortunately, year-to-year returns don’t matter so much if you have a life expectancy of thirty years. Looking at the Mountain Chart for clients who have been here 30+ years is a good reminder of what’s important. It’s not the yearly ups and downs, regardless how extreme; it’s the long-term trend line that matters.

I hope you have a wonderful fall weekend. Call us if you need us.

Rick Adkins, CFP®, ChFC, MBA

![]()

© 2023 The Arkansas Financial Group, Inc., All rights reserved.

The Arkansas Financial Group, Inc. is a Fee-Only Financial Planning Firm located in Little Rock, AR serving clients in Arkansas and throughout the country.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. [“AFG]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from AFG. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the AFG’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.arfinancial.com.

Please Remember: If you are a AFG client, please contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.