The Bitcoin Bandwagon…Some Cautionary Thoughts

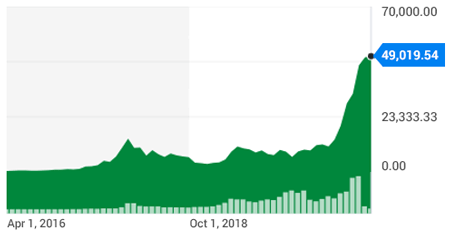

Bitcoin just sounds so sexy and irresistible. It has “cool,” “hip,” “savvy” written all over it. After all, the price has gone from $1 about 10 years ago to almost $50,000 recently. What could possibly go wrong?

So what is Bitcoin?

Most people still have no idea what it actually is nor how it works. Bitcoin is supported by a database of technology called Blockchain. According to the Merriam-Webster dictionary:

Blockchain is a digital database containing information (such as records of financial transactions) that can be simultaneously used and shared within a large decentralized, publicly accessible network.

Blockchain is a system that accountants love because blockchain ledgers are allegedly tamper proof. However, it is still a very young technology, and Bitcoin is only one of many crypto currencies. According to CoinMarketCap, 8,695 crypto currencies exist today. According to www.Coinopsy.com (which tracks coin failures) at least 1,882 crypto currencies have failed since they started tracking about 10 years ago.

Reasons not to jump on the bandwagon

There are four reasons why you may not want to be so quick to jump on the Bitcoin Bandwagon:

- Unregulated

- Blackbox

- Competition

- Internal Revenue Service (IRS)

1 Unregulated

When I say unregulated, that means there are no recognized government authorities, no country, no one – except the creator – establishing rules or governing its authenticity and existence. That doesn’t mean it isn’t real or doesn’t have value. There is simply no government, like the United States of America that backs the integrity, value and structure of the currency.

Think of the Kingdom of Zamunda instead (for you Eddie Murphy fans). Think of the deregulated Texas electric cooperatives as a more recent example. Or perhaps think of your old neighbor’s moonshine from an uncle in Kentucky. Or maybe think of the $1 cough remedy you bought at the dollar store because you thought it was a good deal.

2 Blackbox

This means you really do not know what you are buying or who the people are that are standing behind it. Even the origins of the most famous crypto currency, Bitcoin, ticker symbol BTC, are a bit nebulous.

Also, do you know what happens if you lose the passcode to your virtual wallet? Or what if you die in a car crash, and your password dies with you? Or what if someone steals (hacks into) your virtual wallet? Do you call the virtual currency police? Do you send the virtual currency police an e-mail and complain? Perhaps you could just go down to the virtual police station and file a police report that your crypto currency disappeared in cyber-space?

3 Competition

More virtual currency is coming. Eventually we will see regulation and standardization. Originally, one of the main motivations for people to use crypto currencies was, and still is, the ability to hide financial transactions from governing authorities. That leads us to our final reason.

4 The IRS

The 2020 Form 1040 is quite interesting this tax season. Right under your name and address is a very prominent block:

At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?

Yes or No

In all my years as a CPA, I have never observed the Internal Revenue Service being so overt about their desire to know if a taxpayer has a specific investment/asset. They are obviously wanting to tax transaction gains related to currency trades. The bigger issue, even for those just holding it for fun or speculation, is whether Bitcoin will be a big, red, audit flag.

Bottom line: We don’t recommend it

The good news is that in the future, I’m sure we will have much more faith in crypto currencies. Banks and investment companies are looking for ways to make it more mainstream.

However, for now, we take our responsibility serving as your fiduciary very seriously. We do not recommend crypto currencies in their current form. However, we do want our clients to be aware of the pros and cons of ownership, and what it is all about. Fidelity has a very easy to read piece on their website. It gives a bit more information than I have provided here.

http://www.fidelity.com/viewpoints/active-investor/beyond-bitcoin

For most people who are dabbling in it, it provides an opportunity to obtain more knowledge or to experience a bit of a gambling thrill. I wish those people well. For me, it is a bit like putting unregulated gas in my car. I’m just not there yet.

Kristina Bolhouse CPA/PFS, CFP®

Vice President/Shareholder

![]()

© 2021 The Arkansas Financial Group, Inc., All rights reserved.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. (“AFG”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from AFG. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of AFG’s current written disclosure Brochure discussing our advisory services and fees is available upon request.

Please Note: If you are a AFG client, please remember to contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. AFG shall continue to rely on the accuracy of information that you have provided.

Cryptocurrency: Crypto is a digital currency that can be used to buy goods and services, but uses an online ledger with strong cryptography (i.e., a method of protecting information and communications through the use of codes) to secure online transactions. Unlike conventional currencies issued by a monetary authority, cryptocurrencies are generally not controlled or regulated and their price is determined by the supply and demand of their market. Please Note: Arkansas Financial does not recommend or advocate the purchase of, or investment in, cryptocurrencies. Arkansas Financial considers such an investment to be speculative. Please Also Note: Those who invest in cryptocurrency must be prepared for the potential for liquidity constraints, extreme price volatility and complete loss of principal.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.