So, You Think You Want an “Election Portfolio”

Earlier this week I received an email from a reporter asking to schedule time for an interview. The point of the article was for me to suggest ways that would help people get their portfolios ready based on what they think might happen in the Presidential Election. I mean, what could go wrong with that?! I’ve pretty much received a similar call every election cycle and have given the same advice each time – DON’T DO IT!!

First, Presidential Elections are fraught with extreme emotion. Each side paints the other candidate with the most extreme paintbrush they can conjure up. If you’ve listened to the lyrics in “Hamilton” you realize that this is not a recent phenomenon. Some candidates don’t even need the help of their opponent to be made to look bad. I’ll never be able to get the picture of Michael Dukakis wearing that tank helmet out of my head or forget the way Gerald Ford was portrayed by Chevy Chase on Saturday Night Live. Neither of those were rational reasons to vote for or against anyone but they still play a role if we’re not careful.

RULE #1: Don’t let the emotion of an election drive your portfolio decisions.

But moving to Mexico or Canada is permissible, assuming we are permitted to travel there. Let me give you a classic example of why this rule is so important. In 1992, one of our clients with a relatively large portfolio called in early October. The polls were beginning to indicate that Bill Clinton was likely to defeat George H.W. Bush. In this client’s mind, this would be tantamount to the end of Western Civilization, as we knew it. So, he proceeded to have us liquidate his entire stock portfolio, creating a sizable amount of taxable capital gains.

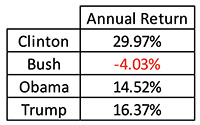

How, you might ask, did that work out for him? Over the next eight years, the S&P 500 increased 239.75%, having an average annual return of 29.97%! To make matters worse, having made that extreme commitment, he was paralyzed in his ability to get back into the market. He just knew if he did, the markets would tank.

RULE #2: If you do something stupid while violating Rule #1, do not compound it by being bull-headed.

Take action to correct the mistake as soon as your ego permits. Party stereotypes create their own set of problems during election years. For years the Republican Party touted itself as the party of big business, fiscal conservatism, and low deficits – basically the party of Milton Friedman. The Democratic Party, particularly after Lyndon Johnson, was painted as the party of unbridled social spending and having a penchant for getting us into wars. Boy has this changed.

Let’s see how all of this has translated into the stock market over the past twenty-eight years. I have already noted the S&P 500 return under Clinton. The next President, George W. Bush was a Republican who got us into both a war and the greatest financial mess we have seen since the Great Depression. After seven years of flat returns, his last year saw a decline of -39.99%, resulting in an average annual return of -4.03%.

The Obama years saw an astounding recovery from the decline from the Financial Crisis of 2008 that ended on March 9, 2009. The market increased 76.13% over the remainder of his administration.

Under the Trump Administration, the stock market has increased an average of 16.37% per year. Yet, that whole bit about deficits had gone out the window even before COVID-19, with a tax bill that dramatically cut the tax bills of the ultra-wealthy. The mere-wealthy and everyone else got little. The outcome was skyrocketing structural deficits.

RULE #3: Do not buy into party stereotypes.

Not only are stereotypes not grounded in reality, they can be incredibly wrong about what might happen in the future.

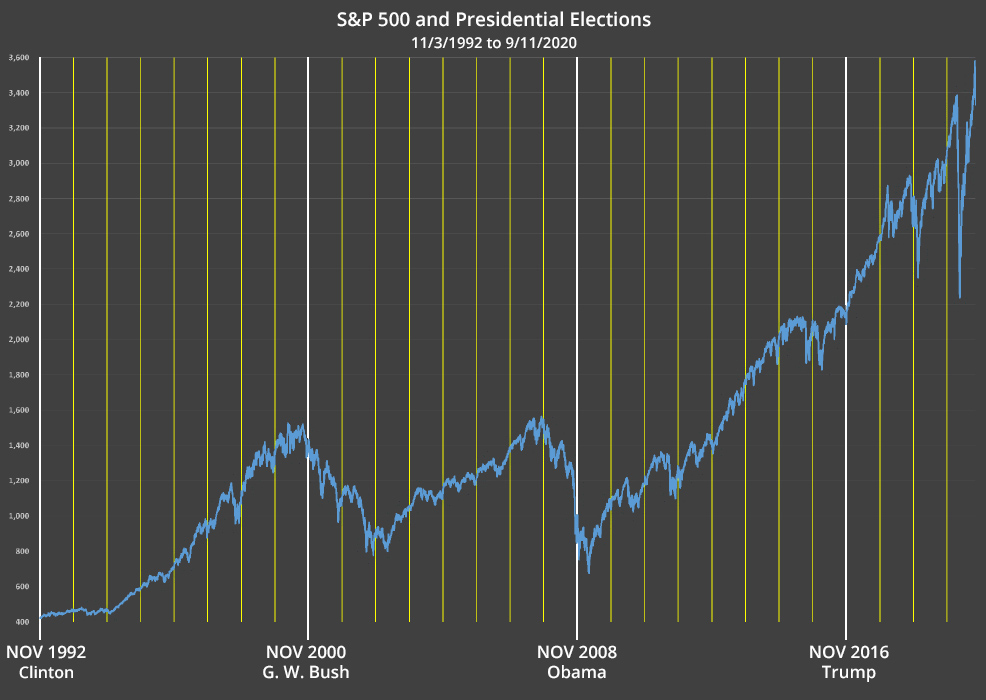

Here’s the chart of the S&P 500 for the last four Presidential administrations over 28 years. If you think back on how you felt going into each of the four elections that began those Presidencies, how accurate were you about what would happen? Notice there have been significant drops in each of the past three administrations.

I would suggest that the biggest potential change if Biden were elected is that the tax rates on the ultra-wealthy are likely to go up. So if you earn more than a couple of million dollars per year get ready, and adjust your portfolio accordingly. Yet, even for you I wouldn’t recommend going to cash. History would dictate otherwise!

As always, we are here for you. Please email or call if you want to set up a Zoom videoconference meeting or talk by phone

Rick Adkins, CFP®, ChFC, MBA

© 2020 The Arkansas Financial Group, Inc., All rights reserved.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. (“AFG”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from AFG. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of AFG’s current written disclosure Brochure discussing our advisory services and fees is available upon request.

Please Note: If you are a AFG client, please remember to contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. AFG shall continue to rely on the accuracy of information that you have provided.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.