Oh, What a Difference a Year Makes!

This time last March was an incredibly stressful period – emotionally for many people and logistically and mechanically for us. On a normal day, I might have had ten to fifteen households that needed rebalancing attention. Last year, for several successive days, I probably had seventy or eighty households that were out of balance. On some days I could not physically get through them all.

Our most important focus was to do nothing that caused long-term harm. People were hearing their friends talk about “going to cash.” That was absolutely the worst action you could have taken during that time. This was particularly true since, as it turned out, the markets were going to correct so quickly. We were trying to avoid selling any equities, using bond holdings to fund monthly distributions to clients, and to fund the purchase of equities that were at depressed prices.

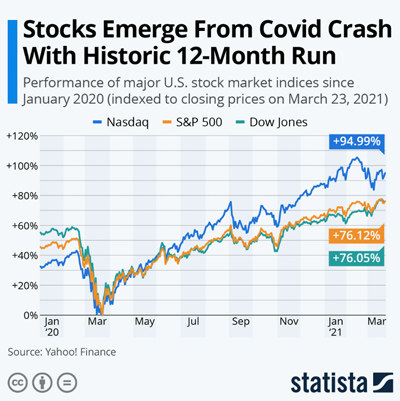

The headlines and the television news leads kept shouting the fact that the Dow and the S&P 500 Index were down 30 – 40%, depending on the day. Oil prices absolutely tanked. None of us knew what was going to happen to the economy with a pandemic in full bloom. So, how did that turn out?

This chart shows the remarkable crash and rebound that transpired over the past twelve months. One year ago, I never dreamed equity markets would be where they are now.

Gratitude

Looking back, I am grateful for the stimulus and PPP program that the Fed, the Treasury, and Congress supported and put into place. They quickly gave people hope and stopped the downward slide. I am grateful to Governor Hutchison and Dr. Nate Smith, who went in front of Arkansans daily and stressed the importance of wearing masks, distancing, and reopening businesses in a very smart, strategic manner. I am grateful to the pharmaceutical companies who worked hard to develop, test, and manufacture the vaccines that became a reality in less than a year. I am grateful hospitalizations and active cases from COVID have dropped dramatically. I am grateful that we are on the verge of being able to vaccinate any adult that wants to be vaccinated. I will be ecstatic when my grandchildren can get vaccinated.

We are still surrounded by loss

In the meantime, I still think about all the friends who have lost loved ones over the past year. While things may look somewhat rosy for the living, the loss of your Mom or Grandmother isn’t soothed by a roaring stock market. Even if your loved one was not ill with COVID, it was a terrible time to be in a hospital or nursing home. You were alone, isolated from your family. Many died with no one who loved them in the room. It’s been an awful time that we will not soon forget.

Looking forward, I have no idea what to expect next. I believe we are in for a crazy ride over the next year. I do believe that life will not be the same “after COVID.” When you add in the fact that we may never feel safe just going to the grocery anymore, we may just keep ordering groceries online! We will probably have meetings over Zoom henceforth with many of our clients. Office space may get a lot cheaper. With all the renovations, homes and yards are going to be much nicer. My hope is that we find more, not fewer, ways to be with friends and loved ones. My real hope for you is that you find more serenity and contentment from your life ahead, no matter what happens to you.

As always, we are here for you. Please email or call if you want to set up a Zoom videoconference meeting or talk by phone.

Rick Adkins, CFP®, ChFC, MBA

![]()

© 2021 The Arkansas Financial Group, Inc., All rights reserved.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. (“AFG”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from AFG. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of AFG’s current written disclosure Brochure discussing our advisory services and fees is available upon request.

Please Note: If you are a AFG client, please remember to contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. AFG shall continue to rely on the accuracy of information that you have provided.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.