Longevity Planning

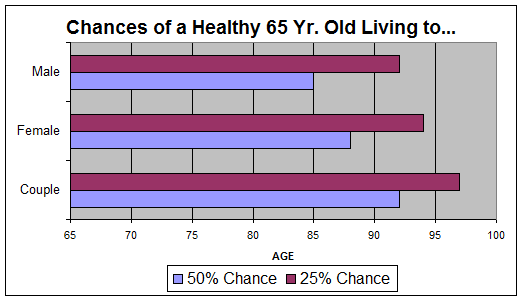

For the past twenty years, most financial planners have used Mortality Tables to help them compute the adequacy of asset levels for funding retirement income needs. These tables were based on the actual life span of general population in the United States. Those wanting to be more conservative used tables based on those individuals “wealthy” enough to buy life insurance. Thinking that we were being “belt and suspenders” conservative, we’ve used Annuity Tables, which pushed expected life spans even further. Each of these tables yields a shorter expected life span than the table shown above. Rather than 81 or 83, this table pushes Male life expectancy out to 85. Instead of 84 or 86, it pushes Female life expectancy out to 88. The numbers really press on out there when you lower the odds to 1 in 4 instead of 1 in 2, and you consider the Joint Life Expectancy of a couple, rather than individuals. Bottom line: For each couple reaching age 65 in “healthy” shape, there’s a 25% chance that one of them will live to be 97! That has profound implications on retirement sufficiency calculations. It also adds a new twist to the Mark Twain quote, “If I’d known I’d live this long, I’d have taken better care of myself.” He should have said, “If I’d known I’d live this long, I’d have taken better care of my money.”

There’s a second factor hanging over our heads like the Sword of Damocles – that’s healthcare costs for retirees. Over their joint lifespan, a couple retiring at age 65 can expect to spend approximately $260,000 on healthcare costs. These two issues – longer life spans and increasing healthcare costs – cause us great concern and increase our interest in improving our resources for answering the most critical financial question you face, “When can I afford to retire?”

IMPORTANT DISCLOSURE INFORMATION

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc.-“AFG”), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from AFG. Please remember that if you are a AFG client, it remains your responsibility to advise AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. AFG is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the AFG’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request. Please Note: AFG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to AFG’s web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.