How to Become a Wise Donor

Tools & considerations for evaluating charitable organizations

The ads on television for charities can be so compelling. Yet do you ever question if you are getting the full story? Do you ever wonder if your money would really make it to the charity? Would your money all go to solve the problem as advertised? And who is paying for those commercials? Do the networks and cable stations allow them to advertise for free–out of the goodness of their corporate hearts?

Do you get confused when you hear that a charity is a “501(c)3” and wonder what that means? What about donations given to individuals for a charitable purpose — such as giving cash to a neighbor that is going on a mission trip. Is that okay? Does it qualify for an IRS deduction? Are you worried about friends or relatives that are giving significant amounts to charities? Are you concerned that they may be getting scammed?

As a former auditor, I am always suspicious at marketing following major catastrophic events. Invariably, charities I’ve never heard of start running commercials pulling heartstrings and purporting to help. I am even more suspicious of the commercials designed to engender pity for the disabled or children.

In the past, I have observed rock concerts and celebrity fundraisers that support communities after horrific events. Later, news stories surface about how the funds were not used the way donors thought they would be. You may have observed this as well and been frustrated that donor funds were mishandled.

How can you become a wise donor?

A little research can help answer some of these questions. Here are a few tools and considerations to help evaluate potential charities that are worthy causes:

- Use internet tools such GuideStar, Charity Navigator, Give.org, or Giving Compass to research information on charities.

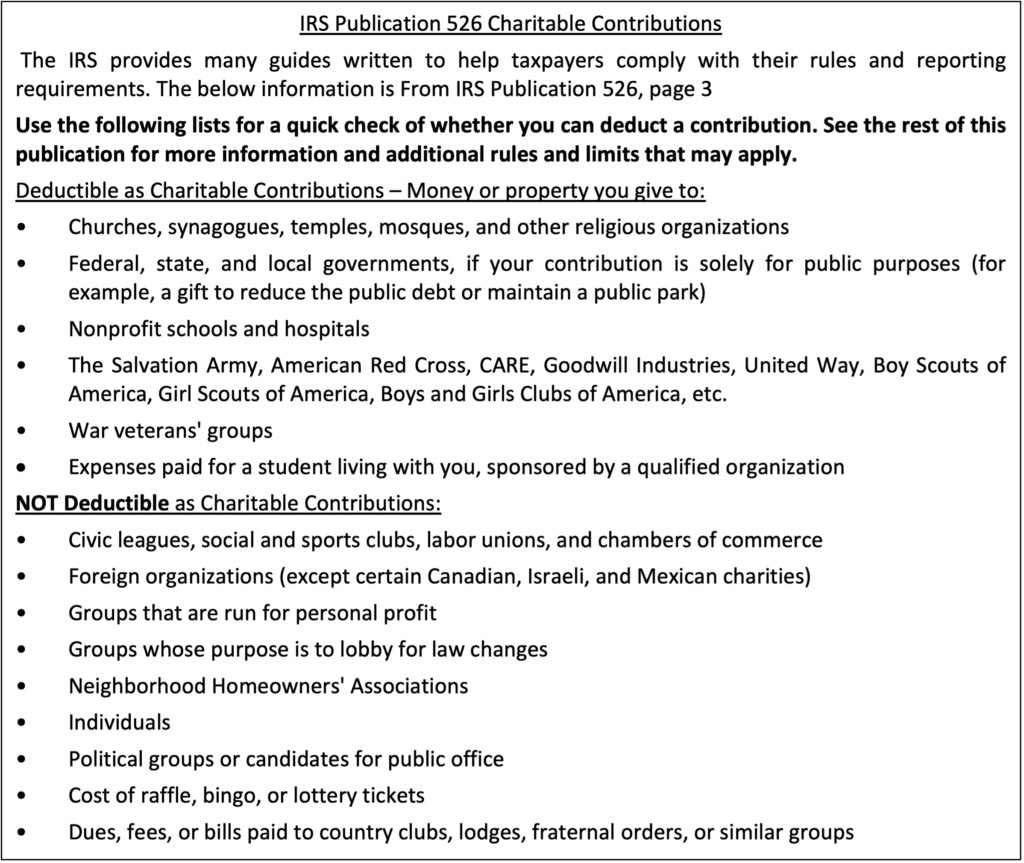

- Determine if the organization is a qualified charity according to the Internal Revenue Service. (See notes below from IRS Publication 526.) Even if it is not, it may still be an organization that you might want to support — such as your kids’ sports teams, your neighborhood association, or a political organization.

- Determine, if possible, the percentage of donation dollars that are used to pay for advertising and other administrative costs. How difficult is this to find?

- According to GuideStar, one of the first questions to determine is “Does the organization have an EIN—Employer Identification Number?” An EIN is required to file tax returns with the IRS. So, if they have an EIN, that means that at least they have registered with the IRS. Check the IRS search tool below if you want to check on a specific organization: https://apps.irs.gov/app/eos/

- Do they provide public reporting of their finances? While 501(c)3 types of organizations are required to file an annual Form 990, churches are exempt from this requirement. Some churches provide regular reports of financial information to church members, but many do not. You may be fine with that, but it is worth considering this as part of your overall charitable planning strategy.

- How far removed are you from the organization? Are friends involved in the charity? Are you aware because of the charity’s impact or reputation in your community? If so, you may have confidence without needing to do much research. If the cause is related to projects in a foreign country or an organization thousands of miles away, you may want to do more in-depth research.

These points may help save you from feeling regret from supporting an organization that you later find out was not legitimate. Of equal concern is the corporate governance of the charity. A charity with poor governance is a disaster waiting to happen. This may also make you feel squeamish about donating to it.

Not all noble causes will result in qualifying for a tax deduction. There may be times that you want to give to a worthy cause and there is no EIN or 501(c)3 status. If so, no tax deduction. You may simply want the good feeling of helping a person, a project, or engaging in an act of kindness. If it does not violate any other rules (such as the IRS gifting rules for individuals), there is nothing illegal about being generous.

As always, we are here to answer questions you may have in this area. Feel free to reach out to us if you need specific guidance in this area.

Kristina Bolhouse, CPA/PFS, CFP®

Vice President/Shareholder

![]()

© 2022 The Arkansas Financial Group, Inc., All rights reserved.

The Arkansas Financial Group, Inc. is a Fee-Only Financial Planning Firm located in Little Rock, AR serving clients in Arkansas and throughout the country.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. [“AFG]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from AFG. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the AFG’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.arfinancial.com.

Please Remember: If you are a AFG client, please contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.