How Exciting is Your Ride?

Over the past forty years, I’ve been an observer as clients have picked the level of excitement they thought they wanted in their portfolio. Very few of them are the same. None of them are wrong – until they are. Self-knowledge can be a challenge.

This current period of volatility (and it’s not over yet) has shown similar characteristics to 1987, 2001 and 2008-09:

- Something triggered a “scare” (that “something” can be real or contrived)

- It quickly got magnified in the popular press

- The herd instinct kicked in for some people, causing them to compulsively bail out of the market near the bottom

- Then they froze and were indecisive about when it was safe to get back in

There have been a number of interesting studies on the detrimental impact of this behavior. Mitigating the impact of this behavior is one of the most important services we provide our clients. Portfolio Theory relates to the combining of multiple Asset Classes to reduce the volatility of the portfolio while maintaining a reasonable return. Portfolio Theory has made a profound difference on emotional well-being and ultimately on the creation of wealth. This year has been a classic “real-world” example of how it works.

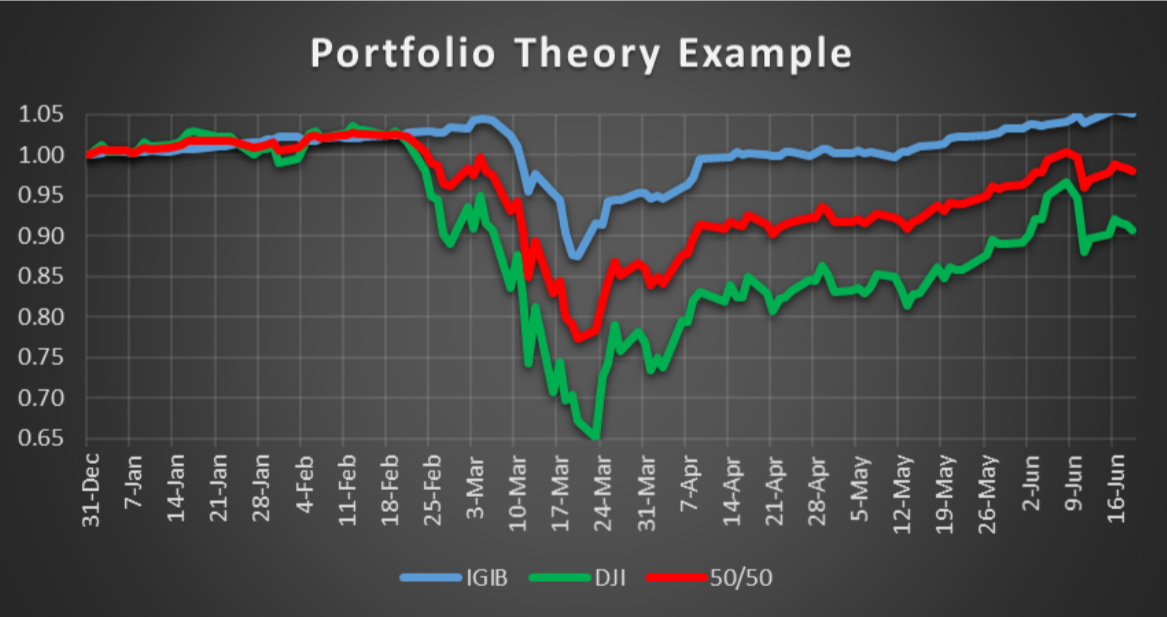

This graph shows the year-to-date results for three portfolios: Intermediate Corp. Bonds (IGIB) (Blue), Dow Jones Industrials (Green) and a portfolio of 50% in each (Red).

Things were rocking along nicely through February 19th. The Dow was up 2.84% in 34 days, putting it on track for an annual return of 16.7%. Then news about this COVID virus started growing about a month after people travelling back from China had been getting sick. It became an obsession with news outlets. The nursing home incident in Seattle really caught the public’s attention. Over the next four weeks, we were rightly provided information that would, for a period of time, scare us into behaviors that would help us avoid another 1918 disaster.

Unfortunately, there were two other behaviors that materialized:

1. The hoarding of Toilet Paper, and

2. The dumping of Stocks.

Ironically, after two weeks of falling Stocks, the Bond Market was impacted due to liquidity issues created by people scrambling into money market instruments and Bonds. Even Bonds saw a brief but surprising decline.

I noticed a positive change in Bonds on March 18th. At the time I didn’t know what the Fed was doing. That became apparent in a couple of days. They were flooding the markets with liquidity – the availability of cash. On the following Monday (3/23) Stocks hit “bottom.” From that point until June 8th we saw a pretty amazing recovery in the major Stock indices.

Which line do you prefer when you look at the graph above: Green, Red or Blue? Let me give you a bit more data.

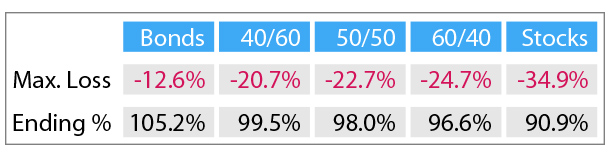

The following table shows the Maximum Loss and the Ending Percentage of value for Bonds and Stocks. It additionally shows three portfolios containing Stocks at 40%, 50%, and 60% of the total portfolio.

I should warn you that you should never make a serious investment decision and take action on four months of data. When we construct a portfolio, we’re generally using thirty years of data. I’m just showing you this as a real-world example of a very simple, two Asset-Class portfolio.

Yet, even in this example, the most important first question is “How much short-term loss can you tolerate?” The second most important question is “What will you need to accumulate by the time you retire to be able to live comfortably after you quit working?” Everything else is pretty much noise.

Neither Stocks nor Bonds are inherently good or bad; they are both tools that can help a portfolio weather volatility. During the months of March and April, Bonds allowed us to fund monthly retirement distributions without harming portfolios by selling Stocks while they were down.

Since your portfolio actually holds between eight to fourteen Asset Classes (not just two) rebalancing played an important role during this period. Several Asset Classes dropped, having declines of greater than 25%. This caused us to buy more when that happened. We’ve already seen the benefit from that discipline. Several of our clients saw their YTD returns actually go positive prior to June 8th. Virtually all of our clients now have a positive 12-month rate of return.

How are you enjoying your ride this year? Your ride will never be totally smooth and the bumps are the price of longer-term returns! Call us if you want to change your ride!

Rick Adkins, CFP®, ChFC, MBA

Copyright © 2020 The Arkansas Financial Group, Inc., All rights reserved.

IMPORTANT DISCLOSURE INFORMATION

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc.-“AFG”), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from AFG.

Please remember that if you are a AFG client, it remains your responsibility to advise AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. AFG is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the AFG’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request.

Please Note: AFG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to AFG’s web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.