Financial Aggregators

By: Ralph Broadwater, MD, CFP®, AIF®

Financial aggregators can be an excellent tool to help you follow your finances, investments, and track spending patterns. These web-based programs allow you to automatically capture all of your financial accounts and transactions in one location. Some of the types of information that can be collected:

- Bank Accounts

- Investment Accounts

- Loans

- Retirement Accounts

- Credit Card Transactions

- Frequent flier and reward program balances

- Email accounts

- Manual entry of other account information

After entering the login and password information for each account, the accounts will be automatically updated and displayed for your review. Real time net worth can be followed, and graphed over time. Credit card transactions are automatically assigned to categories, allowing you to more rapidly analyze spending and expenses.

There are several free aggregators to choose from on the web. I have tried most of them on my own personal accounts, and would like to recommend two of them for you to explore.

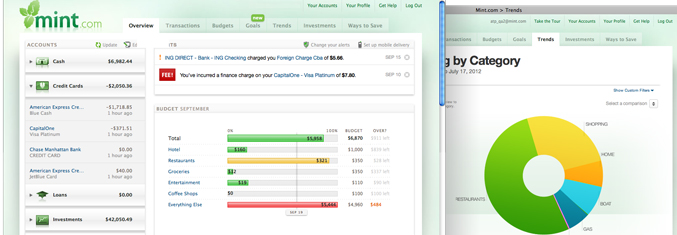

In my opinion, Mint.com is the best overall aggregator. It has an excellent, clean interface and is simple to use. After spending approximately 30 minutes of setting up your accounts, it will capture all of your transactions on an ongoing basis.

One of the most useful features of mint.com is the ability to establish alerts. For example, you can define alerts to notify you by email or text for the following:

- low balances

- bill due

- unusual spending (over a specified amount) by category

- overbudget in a category

- changes in credit card interest rate

- bank fees

- any large purchases

- large deposits

This is an excellent tool to be alerted of significant changes, and can enhance your monitoring for credit card fraud or theft.

Most aggregators (including mint.com) use the back office engine of Yodlee for aggregation. While you may have security concerns about putting all of your login and password information in one place, they use bank level security and 128 bit SSL encryption on all information. Mint.com captures no personally identifiable information other than your e-mail address and zip code. Your name, address, or any account numbers are not collected. You cannot move or transfer money through these services. The potential for any identity theft or fraud is remote.

I really like the ability to customize categories and budgets. The graphics are a powerful tool to examine spending patterns, and identify trends.

The second program that you should explore is in the fidelity.com website. It is called FullView, and is accessed at the end of the accounts menu. FullView has most all of the features of mint.com. It seems a little more “buggy”, and does not have as clean of a graphic interface. It is a good solution for those who use Fidelity’s website regularly and want all of their finances in one place on the web. There is not an iPhone app for FullView.

There are several other aggregators that are available. I have listed them below:

- Bank of America: My Portfolio

- Yodlee/ MoneyCenter

- Quicken Online

- JustThrive.com

- Wesabe.com

- MoneyStrands.com

- Rudder.com

- Geezeo.com

Financial aggregators will streamline your financial life and can provide additional protection against credit card and financial fraud. The ability to automate your finances and view spending patterns graphically is a very powerful tool to help you better understand and improve your financial and investment life.

®2013 The Arkansas Financial Group, Inc., All Rights Reserved

IMPORTANT DISCLOSURE INFORMATION

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc.-“AFG”), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from AFG. Please remember that if you are a AFG client, it remains your responsibility to advise AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. AFG is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the AFG’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request. Please Note: AFG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to AFG’s web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.