Being Wealthy vs. Feeling Wealthy

In March 2023 Logica Research conducted the Modern Wealth Survey. This was a study of 1,200 adults on behalf of Charles Schwab & Co., Inc. The first big takeaway is that Americans now consider that you need to have a Net Worth of $2.2 million or more to be considered wealthy. Being wealthy under this standard is merely a “fact of perception.” It isn’t a “fact-fact” like being blue-eyed or brown-eyed; under age 65 or over age 65, etc.

The second big takeaway is how the survey participants felt about wealth – particularly their own wealth. Interestingly, 48% of the participants felt wealthy. You might infer that 48% of the participants had a Net Worth more than $2.2 million. In fact, the average net worth of the participants was $560,000! How can this be?

What does wealth mean to you?

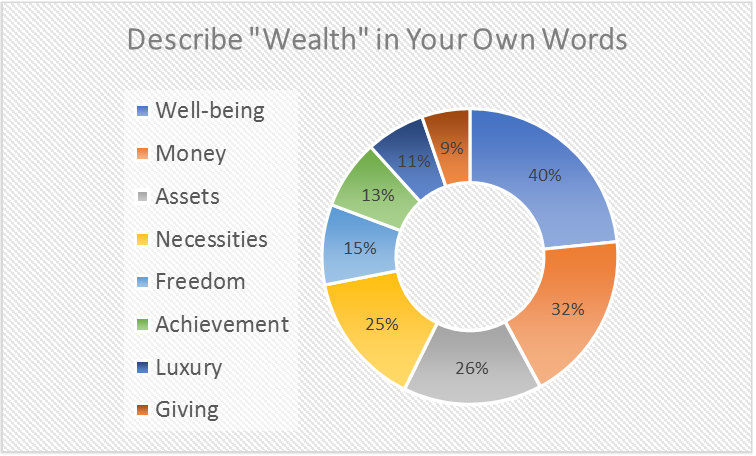

When asked to describe “Wealth” in their own words, here’s how participants answered:

When participants defined Wealth, they were asked a “How much” question which forced them into the Money bucket. Yet, when they described Wealth, 68% responded with what money does, not what money is.

Maslow’s Hierarchy of Needs

In looking at their words describing wealth, I was brought back to Abraham Maslow’s view of human needs (shown in chart below). Using his concept here’s how I grouped the responses:

- One-Fourth of respondents essentially said, “If my Physiological Needs – necessities – are met, I feel wealthy.”

- Fifty-eight percent believed having their Safety Needs met – Money and Assets – made them feel wealthy.

- The largest single group believed that their Love and Belonging Needs – Well-being – made them feel wealthy.

- Esteem Needs – Luxury, Achievement and Freedom – were the measures that caused thirty-nine percent to feel wealthy.

- Finally, Self-Actualization Needs – depending on their motivations for Giving – is how nine percent defined feeling wealthy.

Do you feel wealthy?

To bring this issue to a personal level, I’ll borrow from an infamous Dirty Harry question: So, do you feel wealthy? If you don’t, what would need to happen for that to change? Do you even care if it changes? If you consider yourself wealthy, at what point in life did you begin to feel wealthy? Was there an event? Was it a number? Was it exposure to someone else’s challenging situation?

In whatever manner you might have come to feel wealthy, your perception will change over time. For some of our clients, feeling wealthy has long since quit being “a number,” for them it’s something deeper. They remind me of The Giving Pledge folks. When Warren Buffet and Bill Gates persuaded thirty-eight fellow billionaires in 2010 to commit half of their wealth to good causes there was more than a number involved. There was meaning, purpose and intentionality behind The Giving Pledge. Over time, The Giving Pledge list has grown to include over 235 individuals and families.

Self-Actualization clearly involves a degree of the money element. Those first four needs of the hierarchy must have been achieved to some extent. Yet, I do not think those buckets have to be full before Self-Actualization can start growing. Self-Actualization is more of a “heart thing.” Some hearts are generous, some are not. Generosity transcends money – it is a response to needs of others. It is compassion in action. If your heart is tugging in this direction, let us know. We can help. Other clients are already walking this path.

Rick Adkins, CFP®, ChFC, MBA

![]()

© 2023 The Arkansas Financial Group, Inc., All rights reserved.

The Arkansas Financial Group, Inc. is a Fee-Only Financial Planning Firm located in Little Rock, AR serving clients in Arkansas and throughout the country.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. [“AFG]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from AFG. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the AFG’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.arfinancial.com.

Please Remember: If you are a AFG client, please contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.