Are We There Yet?

If you’ve traveled with kids this summer, you might have heard that question. You may also have asked that question yourself about inflation. Hopefully you saw the news that our inflation rate for June has dropped to 3%! That’s wonderful news. The Fed target is 2%. Twenty percent of the economists answering a recent survey believe the Fed will institute one final rate hike by November. I’m hoping that the inflation statistics continue to cool over the next few months so that they are wrong. It seems like every time the markets start crawling back up, we get another rate hike, and the markets fall.

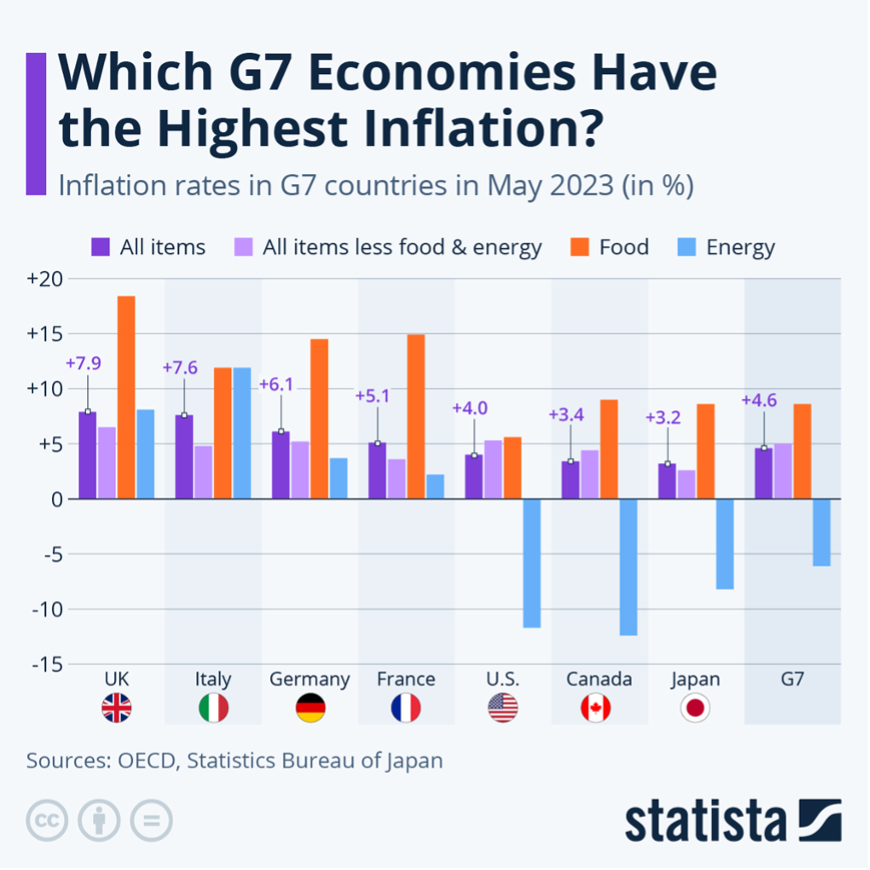

This chart of May inflation shows two things: 1) The US and Canada are benefiting from significant reductions in energy costs that are pulling our overall inflation rate down. Our European friends aren’t so lucky. Great Britan’s inflation rate was almost twice ours due to energy costs.

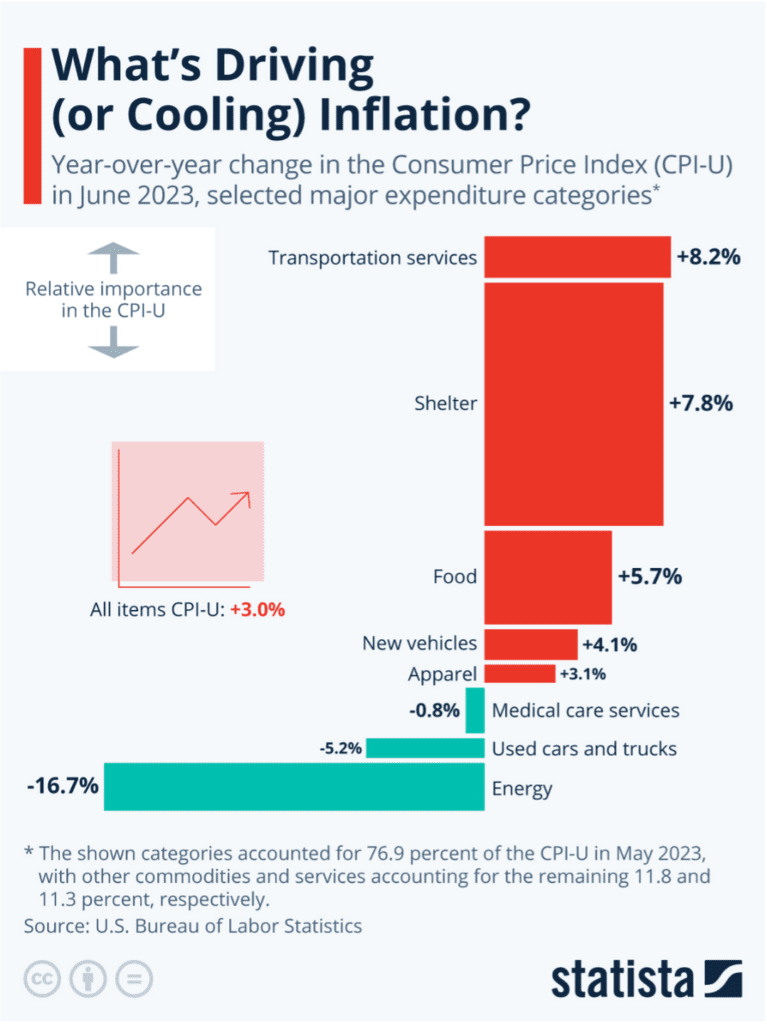

This next chart shows the components of US inflation one month later. These June numbers have given everyone hope that we’re almost there. It is astounding that energy costs have continued to decline with summer travel and heat!

Yet, all is not rosy. Transportation costs are still up almost three times the inflation rate. This is primarily due to airline ticket costs. I suspect that the pent-up travel demand that developed during COVID has something to do with this.

There may be another factor driving up airfare – concert ticket prices in this country. Ticket prices for entertainers such as Beyonce, Bruce Springsteen and Taylor Swift can top $2,500 in this country. It’s different in Europe. In cities like Glasgow, Copenhagen, and Stockholm the same tickets run for less than $200. People are actually booking those cheaper tickets and flying across the pond. This may not apply if you live in Little Rock. But if you live on the east coast, you can generally get cheaper airfare to Europe. You can kill two birds with one stone — visit a wonderful European city and see “The Boss!”

So, keep your fingers crossed. Maybe “we’re almost there” to the Fed’s inflation targets and we’re through with rate increases. I’m ready for a few consecutive months of market growth!

Rick Adkins, CFP®, ChFC, MBA

![]()

© 2023 The Arkansas Financial Group, Inc., All rights reserved.

The Arkansas Financial Group, Inc. is a Fee-Only Financial Planning Firm located in Little Rock, AR serving clients in Arkansas and throughout the country.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. [“AFG]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from AFG. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the AFG’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.arfinancial.com.

Please Remember: If you are a AFG client, please contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.