Advanced Estate Planning: Consider Early Gifting

Three effective strategies for lifetime gifting

Through saving and smart investing, you may have accumulated significant assets to support yourself when you reach retirement. At death, your intention may be that these assets will go to your children and other heirs for their benefit.

Understanding the demographics of longevity will help ensure your planning will accomplish your intended goals.

In the United States today the average lifespan is 76.3 years for males and 81.4 years for females. If a couple are both living at 80, there is a 50% chance that one of the spouses will be living at age 100.

In addition, educated and affluent couples live an average of nine more years than the average male and female. Since these are the averages, half of you will likely live longer than averages predict.

These improvements in lifespan mean that your children will likely be in their sixties or seventies when they receive their inheritance. By that time, they will hopefully be successful in their own careers, reducing the impact of the inheritance.

Surveys have shown that the most meaningful impact of financial gifting occurs between ages 25 and 45. This is when extra help is needed most (e.g. helping a young couple with money for a mortgage down-payment or cash to support a bold career change).

In addition to one time gifts, here are some options to consider for lifetime gifting:

Annual Gifting

I have personal experience with an example of annual gifting. Years ago, my mother-in-law decided that she would gift each year at Easter. We would all go to Easter brunch, and each of her five children and spouses would receive an Easter card with a check for the annual gift amount for each couple. I was able to see firsthand how meaningful this annual gift was for several of the children (who ranged from age 35 to 50).

The amount you can gift to any one person on an annual basis (without filing a gift tax return) has increased to $16,000 in 2022. This is the first increase since 2018. (A couple can give $32,000 per year.)

Any person who gives away $16,000 or less to any one individual (anyone other than their spouse) does not have to report the gift or gifts to the IRS. Any person who gives away more than $16,000 to any one person is required to file Form 709, the gift tax return.

The basic federal estate tax exclusion amount for the estates of decedents dying during calendar year 2022 is now $12,060,000 for individuals and $24,120,000 for couples, up from $11.7 million and $23.4 million for calendar year 2021. The increase in the estate tax exclusion means that the lifetime tax exclusion for gifts is also $12,060,000, as is the generation-skipping transfer tax exemption.

This $12,060,000 lifetime gift tax exclusion means that even if you are required to file Form 709 (because you gave away more than $16,000 to any one person during the year) you will owe taxes only if you have given away more than a total of $12,060,000 in the past. Still, Congress could change the exclusion limit, and the lifetime exclusion is already slated to drop in half in 2026.

Fund a Child’s Roth IRA

There is no age limit for Roth IRA contributions and custodial Roth IRAs can be established for minors. The hurdle to funding an account is ensuring the child has earned income.

- Earned Income: If a kid has earned income, they can contribute to a Roth IRA. Earned income is defined by the IRS as taxable income and wages — money earned from a W-2 job or from self-employment gigs like baby-sitting or dog walking. If you want to contribute to your child’s Roth IRA, that is fine as long as they have at least as much earned income as the total contribution amount.

- Contribution Limits: The Roth IRA contribution limit is $6,000 in 2022 ($7,000 if age 50 or older), or the total of earned income for the year, whichever is less. If a child earns $2,000 baby-sitting, they can contribute up to $2,000 to a Roth IRA.

- Taxes: The child will have to start filing a tax return, and there is no tax deduction for making the Roth contribution.

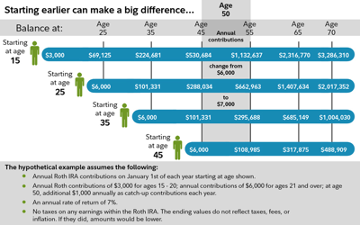

Starting a Roth IRA at a young age is extremely powerful and you can open a Custodial Roth IRA for a minor. All earnings and growth compound tax free, and at retirement withdrawals are not taxed. Starting this account at a young age maximizes the power of compounding and will give the child a great head start on retirement savings.

Matching Retirement or Investment Savings

Another strategy to consider is to offer to match your child’s retirement or investment savings. I am using this approach with my two sons who are young adults to encourage them to save and to teach them about investing.

I recommend that you take time to reflect on your planning and how you want to best help your heirs. If you are interested in lifetime gifting, let us know and we can model out how it could impact your portfolio over time. I hope you find these few suggestions helpful.

We hope you have a very enjoyable summer. Please email or call if you want to set up a meeting or talk by phone.

Ralph Broadwater, M.D., CFP®

![]()

© 2022 The Arkansas Financial Group, Inc., All rights reserved.

The Arkansas Financial Group, Inc. is a Fee-Only Financial Planning Firm located in Little Rock, AR serving clients in Arkansas and throughout the country.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. [“AFG]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from AFG. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the AFG’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.arfinancial.com.

Please Remember: If you are a AFG client, please contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.