2022 Market Analysis: The Crisis?

How the 2022 market stacks up against stock market crashes since 1987

Thomas Paine wrote thirteen pamphlets regarding the Revolutionary War between 1776 and 1783 which he called The American Crisis. The first Crisis pamphlet is the best known. It opens with that famous line, “These are the times that try men’s souls.” Paine signed the pamphlets using the pseudonym, “Common Sense“.

At that moment in time, Washington’s troops were ready to quit. He ordered that Paine’s recently-penned, first pamphlet to be read aloud for his demoralized troops on December 23, 1776. This was just three days before the Battle of Trenton. Two nights later, on Christmas Night he famously crossed the Delaware, surrounded the Hessians, and won a decisive battle. Hearing the reading of the pamphlet must have worked! (Either that, or the Hessians late-into-the-night alcohol consumption on Christmas severely hampered their fighting abilities!)

For the past few days, that famous line has kept popping into my mind in the context of our current financial markets. My first real crisis that “tried men’s souls” was October 19, 1987. Then we had the Tech Bubble; then the Financial Crisis; and then the Covid Crisis. While there have been many others, those were the “biggies.”

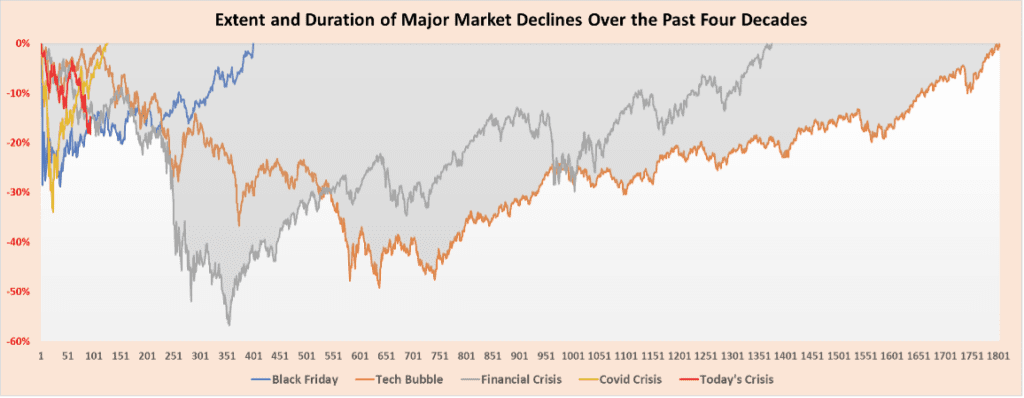

As I am want to do, I built a spreadsheet and graph. I wanted to compare those four clear crises to our current situation. The chart shows the percentage change for the S&P 500 from the beginning of the decline until full recovery. HINT: The red line is our current situation in 2022.

Blue Line: The first crisis was “Black Friday” from 1987. The big drop happened on 10/19/87, but we hit bottom 37 days after the decline began. From beginning to end took 401 market days (almost two calendar years). That one was traumatic because of the two swift declines. We thought it was over and then the second drop hit.

Brown Line: The decade of the nineties was crazy. During the later half you could throw a dart at a technology stock list and make money. That all came crashing down in the early 2000’s. Over a three-year period, we had a series of drops that ended in a cumulative 49.15% decline. It then took about six years to fully recover. Six years! (The next one was worse).

Gray Line: We barely had time to recover before the Financial Crisis began. That decline took about 18 months to culminate in a 56.78% decline, on March 9, 2009. We fully recovered from that “crisis” in about five years. So, although the drop was greater than for the tech bubble, it didn’t last as long.

Gold Line: Things rocked along relatively well from 2013 until 2020. We all got comfortable that the Standard Deviation only worked to the upside. Then Covid hit in 2020. The markets reacted more violently than in 1987, yet fully recovered in about three months!

Red Line: This year has been a constant decline. Through almost five months we have gone down and up but mostly down. We haven’t seen the extreme drops of 1987 or 2020, but we’ve had two periods of decline separated by a brief recovery.

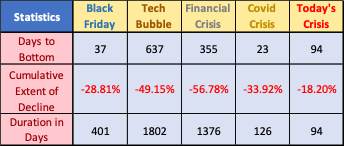

Here are the comparative statistics for these five periods:

I don’t feel any differently about the market than I did when I wrote my part of our last Quarterly Letter, but I’ve now heard concerns expressed by two clients. For a moment, forget the financial markets. Look at the world we now live in:

- We had one of the permanent members of the U.N. Security Council invade a neighbor and threaten the world that if they did anything nuclear weapons would be used to retaliate.

- We are experiencing increased racial tensions due to young men being “shot while driving black” becoming commonplace. To add to that violence, shootings feel like they have been happening routinely – even at graduations. It’s hard to know where you can go in public and feel safe.

- Political cooperation in Washington is virtually non-existent. We’re seeing a number of 51-50 votes in the Senate and the leaking of the upcoming Supreme Court ruling on Roe v. Wade has just added to the extreme political division.

- And now we can’t seem to keep baby formula safely produced in adequate volume. I can’t imagine the stress that new Moms are feeling. That problem is partially symptomatic of the supply chain issues that started two years ago.

For many of the reasons listed above, the world is in an inflationary phase. This isn’t just a U.S. problem. Each Central Bank is trying to address inflation in their own way, but the war in Ukraine is exacerbating the slowness of recovery.

I’ve studied the behavioral side of investing for forty years. I strongly believe that your ability to emotionally handle losses transcends the simple math of market ups and downs. I have watched clients experience other losses: the loss of a job, the loss of a spouse, the loss of a marriage, or a shockingly bad medical diagnosis. I have never seen these experiences not have a significant impact on that client’s comfort with losses. The current world situation is simply another rock on the stress pile.

So, here’s my message: While this isn’t a great time to make changes in your allocation, it is a perfect time for us to have a conversation about the long-term structure of your portfolio. We need to know how you’re feeling, particularly if you’re feeling stressed and your portfolio is significantly adding to your stress. All you have to do is ask Gari to send you a link for a “Touch Base” Zoom Call.

Rick Adkins, CFP®, ChFC, MBA

![]()

© 2022 The Arkansas Financial Group, Inc., All rights reserved.

The Arkansas Financial Group, Inc. is a Fee-Only Financial Planning Firm located in Little Rock, AR serving clients in Arkansas and throughout the country.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Arkansas Financial Group, Inc. [“AFG]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from AFG. AFG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the AFG’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.arfinancial.com.

Please Remember: If you are a AFG client, please contact AFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Form CRS/ADV & Disclosures.

Form CRS/ADV & Disclosures.